Nearly 2 million to be hit by £9 billion “stealth tax bombshell” by the end of the decade

EMBARGO: Immediate Release

The Labour government’s plans to maintain the income tax threshold freezes introduced by the Conservatives mean that an estimated additional 1.9 million people will be hit, forcing them to shell out close to an estimated £9 billion in additional tax receipts by the end of the decade, House of Commons Library research, commissioned by the Liberal Democrats, has revealed.

The Labour government has said that income tax threshold freezes for both the Personal Allowance and the higher rate of income tax will be maintained until April 2028. The impact means that between 2025/26 and 2029/30 an estimated 1.9 million people will be forced to pay a higher rate of tax due to these threshold freezes.

It means for those millions impacted, they will be forced to shell out an estimated £8.9 billion in additional tax as a result of the freezes by the end of the decade.

It follows on from the previous Conservatives government’s decision to freeze tax thresholds in April 2021. The House of Commons Library research says the impact of that 2021 freeze combined with the Labour government’s decision to maintain the freeze means that an estimated additional 7.625 million people will have been dragged into higher tax bands by the end of the decade. That is the equivalent to one in nine of the current UK population.

The total additional tax bill since the 2021 freeze will reach roughly £33.2 billion by 2029/30, rising from £24.3 billion this year.

The hardest hit areas will be London and the South East, where people in both regions hit by the stealth tax will pay out an estimated £3 billion in additional tax from now until the end of the decade. In total, London and the South East will have paid out £11.3 billion in additional taxes by the end of the decade since the April 2021 freeze.

The Liberal Democrats said that the “Conservative economic vandalism led us into this mess, but this Labour government has proven clueless in generating the growth needed to break this stagnation”. The party added that the only way to bring down the tax bill was through meaningful growth and that needed to come from the Government scrapping its jobs tax and negotiating a bespoke UK-EU customs union.

Liberal Democrat Treasury spokesperson, Daisy Cooper MP said:

“During the midst of the worst cost of living crisis for a generation, people are now set to be hammered once again by this stealth tax bombshell.

“People should be rewarded for their hard-work, not seeing earnings ripped away through these punitive measures.

“The Conservatives' economic vandalism led us into this mess, but this Labour government has proven clueless in generating the growth needed to break this stagnation.

“The only way we can bring the tax bill down, protect family finances and rebuild public services is through meaningful economic growth. That has to come from scrapping the Government’s jobs tax and negotiating a bespoke UK-EU customs union to free our businesses from a Gordian Knot of red tape.”

ENDS

Notes to Editors:

First reported by the Times here.

The research by the House of Commons Library can be found here.

Notes from the House of Commons Library:

The Library used a policy simulation model to produce estimates for regions. For UK wide estimates, they used the OBR’s figures from the March 2025 forecast. They are in the ‘detailed forecast tables: receipts’ (table 3.18-3.20).

The Library’s analysis uses the UKMOD policy simulation model version B2025.05 developed and maintained by the Centre for Microsimulation and Policy Analysis (CeMPA) at the University of Essex Institute for Social and Economic Research (ISER), supported by the Nuffield Foundation.

Underlying data on household incomes and circumstances are drawn from the 2020/21-2022/23 Family Resources Survey, adjusted using data from the DWP’s Households Below Average Income, and uprated for later years using the OBR’s March 2025 forecasts.

The UKMOD model is explained in more detail in CeMPA’s latest country report. Section 4.3 of the report summaries health warnings for the model. The Library has not assessed the potential effect of behavioural response of people when faced with different tax thresholds.

The method

This analysis focuses on the freezes to income tax thresholds announced in Spring Budget 2021 (for 2022/23 to 2025/26) and Autumn Statement 2022 (for 2026/27 to 2027/28). These policies mean that:

- the personal allowance is frozen at its April 2021 level of £12,570 until April 2028. The allowance should then increase by inflation in April 2028 and April 2029.

- the higher rate threshold is frozen at its April 2021 level of £50,270 until April 2028. The threshold should then increase by inflation in April 2028 and April 2029.

The Library has not considered other policy changes made to personal taxes (income tax and national insurance contributions) over the period – there’s a summary of these in the OBR’s Fiscal implications of personal tax threshold freezes and reductions.

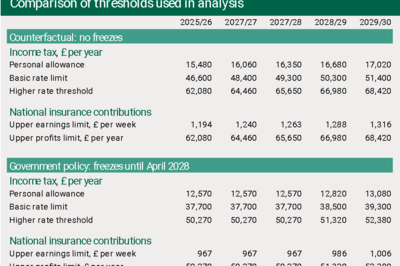

Most National Insurance contributions (NICs) thresholds are now aligned with income tax thresholds. In the Library’s analysis they’ve only aligned thresholds where alignment was happening before the income tax freezes were first announced. Specifically, they align the Upper Earnings Limit (for employee NICs) and the Upper Profits Limit (for self-employed NICs) to the income tax higher rate threshold. The table below shows the thresholds the Library used to compare government policy (with freezes) to a counterfactual policy (with no freezes).

Source: Office for Budget Responsibility. Economic and fiscal outlook – March 2025, supplementary table 3.20

People brought into income tax

Please note these estimates are cumulative and figures from different years should not be summed as this would result in counting individuals more than once.

The Library estimates, for instance, that around 300,000 more people in London will be paying income tax by 2025/26, due to the freeze in the personal allowance, compared with a world in which the allowance had risen with inflation since April 2021.

The regional and country figures in the below table are rounded to the nearest 50,000 people. They are rough estimates and should be reported as such.

Income tax freeze: Exchequer impact

The net figures include the net increases in personal tax revenues and any subsequent changes to the benefits received by households. They do not include any wider direct impacts such as the effect on corporation tax receipts or Scotland’s block grant. The Library has excluded Scotland due to complications relating to Scotland’s devolved elements of income tax policy.

For instance, households in London are around £4.1 billion worse off in 2025/26 in total, relative to a situation in which thresholds had risen with inflation since April 2021.